Navigating the Tax Maze – The Importance of an Accurate Tax Return

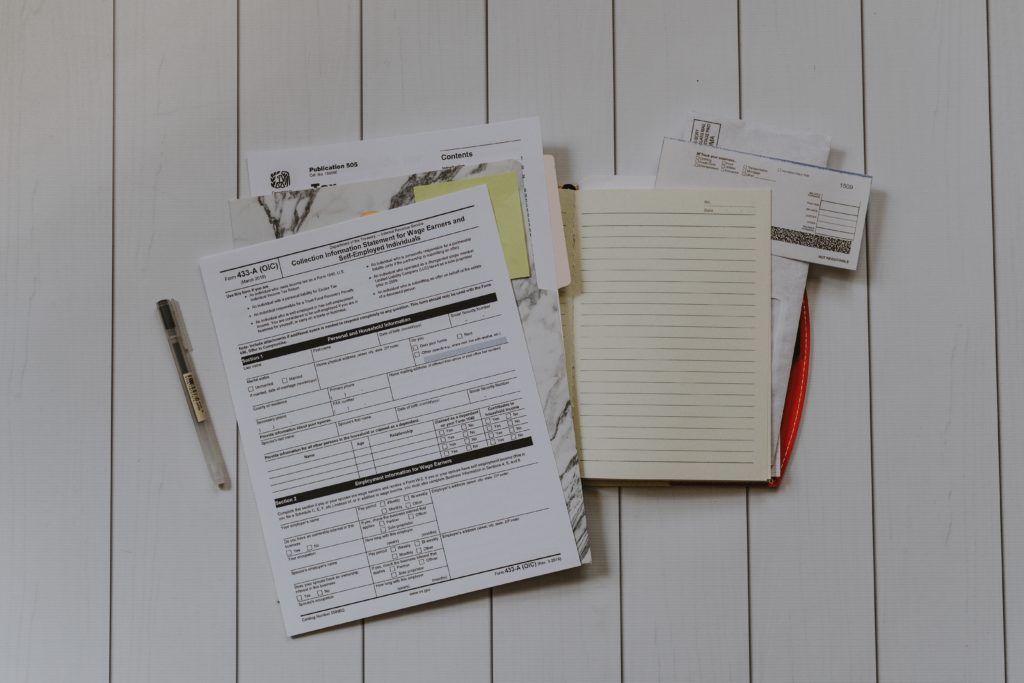

Tax filing is an inevitable aspect of adult life, but it can become a confusing maze without proper guidance. However, when managed correctly, it can be a source of tax advantages and financial peace of mind. In this article, we will explore the importance of an accurate tax return and how it can affect your overall financial situation.

What is the Income Tax Return?

Tax filing is the process by which taxpayers report their annual earnings to the government and pay taxes due based on those earnings. This document is essential for tax compliance and is used by tax authorities to determine the amount of tax you owe or your refund.

The Key to Tax Advantages

An accurate tax return is not only a legal requirement, but also a key to obtaining tax benefits. Through deductions, tax credits and other tax breaks, you can reduce the amount of taxes you have to pay and maximize your refund.

Meeting Deadlines and Avoiding Legal Problems

In addition to tax benefits, an accurate and timely filed tax return protects you from tax penalties and fines. Meeting tax deadlines is essential to avoid legal problems.

Advanced Financial Planning

Filing your taxes is also an opportunity to do some advanced planning for your financial situation. You can evaluate your current situation, identify future tax saving opportunities, and create a long-term financial strategy.

It's time to approach your tax return with confidence, knowing that careful management can improve your overall financial situation.